Photo by Yonhap.

Photo by Yonhap. SEOUL, December 30 (AJP) - South Korea emerged as the world’s best-performing equity market in 2025, with its benchmark KOSPI surging nearly 76 percent over the year. Yet the historic rally came with a paradox: while stock prices soared to record highs, outbound investment overwhelmed domestic buying, leaving the won among the weakest currencies in the region.

The KOSPI closed at 4,214.17 on Dec. 30, the final trading day of the year, nearly doubling from 2,399.49 at the end of 2024. The annual gain of 75.6 percent ranks as the third-largest in the market’s history, behind only the 93 percent rally during the 1987 “three-lows” boom and the 83 percent surge in 1999 at the height of the post-IMF technology bubble.

Few could have imagined such a turnaround at the start of the year. Investor confidence had been badly shaken by political turmoil following a brief declaration of martial law and the subsequent impeachment of the president. Uncertainty lingered through the first half until a snap presidential election in June began to stabilize sentiment.

Optimism strengthened after President Lee Jae Myung pledged to lift the KOSPI to 5,000, injecting momentum into a market long viewed as structurally undervalued. Earlier in the year, volatility had peaked when renewed “Trump-style” tariff threats pushed the KOSPI down to 2,328.2 and the KOSDAQ to 651.3 on April 7 — their lowest levels of 2025.

Foreign investors retreated sharply during that period, unloading 13.6 trillion won ($9.6 billion) worth of Korean equities in April alone. The outflows pushed the monthly average exchange rate to around 1,440 won per dollar, highlighting pressure on the currency. Sentiment began to recover only after the June election, as the new administration rolled out policies aimed at strengthening capital markets and enhancing shareholder returns.

Momentum accelerated in the second half of the year. The KOSPI closed above 3,000 on June 20 for the first time in three and a half years and broke the 4,000 mark intraday on Oct. 27. On Nov. 3, it reached an all-time closing high of 4,221.87, entering uncharted territory 45 years after the index was launched.

Fastest growth among major global markets

Generated with Notebook LM, edited with Google Gemini.

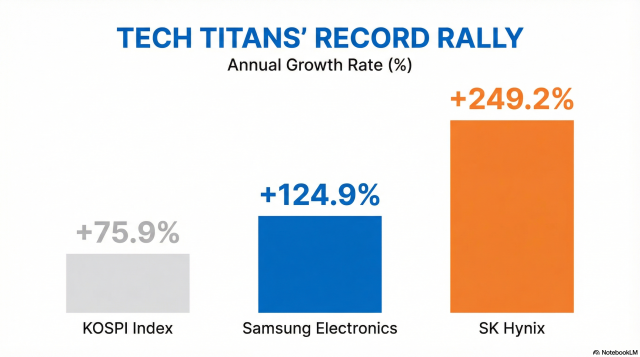

Generated with Notebook LM, edited with Google Gemini. With a 75.6 percent annual return, the KOSPI recorded the strongest performance among major global equity benchmarks in 2025. Japan’s Nikkei 225 rose 26.5 percent, China’s Shanghai Composite gained 18.3 percent, and Taiwan’s Taiex advanced about 25 percent over the same period.

Analysts attribute Korea’s outsized rally to a combination of policy support, ample liquidity and powerful industrial tailwinds, amplified by the global boom in artificial intelligence after the market began the year deeply undervalued.

Chipmakers supplying high-bandwidth memory to Nvidia and other AI leaders emerged as the biggest beneficiaries. Samsung Electronics climbed to 120,000 won for the first time intertrade, while SK Hynix more than tripled in value, hitting a record high.

Generated with Notebook LM

Generated with Notebook LM “The global liquidity environment remains supportive, and strong corporate earnings combined with the AI growth cycle should continue to underpin the market,” said Kim Jong-min, head of research at Samsung Securities.

The tech-heavy KOSDAQ also ranked among the world’s top performers, rising 37 percent for the year. After lagging earlier in 2025, it attracted renewed foreign inflows from October, exceeding 5 trillion won. On Oct. 27, the index closed at 902.7, and on Dec. 4 — nearly a year after the martial law shock — its total market capitalization surpassed 500 trillion won for the first time.

Brokerages reap windfall from rally

Domestic securities firms were among the biggest beneficiaries of the bull run. According to the Financial Supervisory Service, the combined net profit of 60 brokerage houses reached 2.5 trillion won in the third quarter alone, up 60 percent from a year earlier. Their total assets stood at 908.1 trillion won as of late September, more than 20 percent higher than at the end of 2024.

Korea Investment & Securities became the first domestic brokerage to surpass 2 trillion won in cumulative operating profit by the third quarter, with full-year earnings projected to reach 3 trillion won. That would place it close to Nomura Holdings’ 472 billion yen ($3.1 billion) operating profit for fiscal 2024, potentially ranking it third or fourth among Asia’s largest brokerages by earnings in 2025.

A rally at home, but money flows abroad

Despite the historic rise in share prices, capital flows tell a more complex story. According to Bank of Korea data, outbound portfolio investment by Korean residents surged $11.2 billion in September alone, exceeding the $9.1 billion in foreign inflows into Korean securities. Between January and October, residents invested a net $117.1 billion overseas — including $89.9 billion in equities and $27.2 billion in bonds. October alone recorded a record $17.3 billion in outflows.

The scale of these movements suggests not short-term currency speculation but a structural reallocation of portfolios. In that sense, 2025 may be remembered as the year Korea’s stock market delivered its strongest performance on record — even as Korean capital increasingly chose to look abroad.

Kim Yeon-jae Reporter duswogmlwo77@ajupress.com

![[포토] 폭설에 밤 늦게까지 도로 마비](https://image.ajunews.com/content/image/2025/12/05/20251205000920610800.jpg)

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)